DLC iMortgage Capital

Whether you are a first-time buyer or an experienced buyer with excellent credit, DLC iMortgage Capital has access to the very best products and rates available across Canada.

As an alternative lending specialist, we make refinancing your home simple. Our flexible and affordable financing options allow you to access up to 85% of the equity in your home to meet your financial needs.

Being a broker is very different from being a lender. It means that we don’t finance your mortgage – instead, our role is to match you with the right lender to meet your specific needs and to get the banks competing to finance your mortgage.

APPROVED IN LESS THAN 30 MINUTES

We know that you want to eliminate debt and find a solution to your financial situation as quickly and pain-free as possible. When you apply for a mortgage solution with DLC iMortgage Capital, you will have peace of mind in knowing you won’t have to wait days or weeks for an answer. Having to wait for an answer only places additional and unnecessary stress on you during the application process. In fact, you’ll be approved in less than 30 Minutes. That’s right,

you will have an instant solution for your financial situation. We ensure you get the mortgage solution you need, when you need it most.

MEET THE TEAM

We have an experienced team of mortgage agents and brokers with backgrounds in financial planning, insurance, real estate, and business. We have a reputation in the mortgage industry for working with our credit challenged clients to consolidate debt, save them from foreclosures, and assisting in rebuilding their credit ratings. DLC iMortgage Capital team is dedicated to helping you find mortgage solutions that will address your financial need. We are here to help and our team is confident we have the financial solution you are looking for!

SOLUTIONS

Second Mortgages

At iMortgage, we take pride in helping homeowners in all situations people with with poor credit or previous credit issues

Home Equity Loans

Because a home is often our most valuable asset, many homeowners use a Home Equity Line Of Credit (HELOC) for major items.

Refinance Mortgages

Combining all of your debts and adding them onto your mortgage, also known as refinancing, has several advantages. l Call to Action Headline

Debt Consolidation

Our mortgage specialists can help you find the right debt consolidation mortgage for your specific situation.

New to Canada Mortgage

Coming to a new country is a big life change. If you are a new immigrant to Canada, there is a lot to get in order, including getting a mortgage.

Spousal buyout mortgage

Divorce is never easy, but it happens. One source of contention when discussing how to divide the assets is what to do with the house.

Bridge Loans

We make sure that Canadian homeowners have access to the money they need when buying or selling their home by offering bridge loans.

Mortgage Renewals

We offer homeowners a variety of mortgage renewal options to consider, at rates that will beat the banks.

Bad Credit Mortgage

Credit not the greatest and need a mortgage? There are many reasons why your credit may be suffering but we can help!!

Self Employed Mortgage

We pride ourselves in being experts when it comes to arranging self-employed mortgages.

First Time Home Buyer

We offer a wide array of products and services for first-time buyers, helping you to simplify getting a mortgage and purchasing your home.

Home Improvement

We offer solutions for home buyers in all situations, and our mortgage products are designed to help you, regardless of your situation.

GET APPROVED - CALL TODAY

1-888-511-3484

FIRST MORTGAGE RATES AS LOW AS 4.99% / SECOND MORTGAGE RATES AS LOW AS 7.99%

LATEST FROM OUR BLOG

The Mortgage Industry Crisis: Why Only the Strongest Brokers Will Survive

“In the face of adversity, it’s not the strongest who survive, but those who adapt to change the fastest.” – Inspired by Charles Darwin

The Mortgage Industry Crisis: Why Only the Strongest Brokers Will Survive

The mortgage industry is facing a serious downturn. With rising mortgage rates and persistently high home prices, we’re on track for the worst year in the market since 1995—marking the second consecutive year of significant decline. As potential homebuyers remain sidelined due to high borrowing costs, the impact is being felt deeply by mortgage brokers and lenders across the country.

In today’s challenging climate, only the most resilient mortgage professionals will survive. In fact, experts are predicting that as many as one in three brokers could lose their livelihood in the coming months.

The Struggle to Close Deals

For many mortgage brokers, securing new clients and closing deals has become increasingly difficult. According to recent data, nearly 47% of mortgage brokers closed fewer than one deal per month in 2023, a level of productivity that doesn’t even come close to covering basic operating costs. This has led to many brokers working long hours without seeing the financial rewards they once enjoyed.

To make matters worse, median income for mortgage professionals has dropped significantly. From $56,000 in 2022 to $55,800 in 2023, and forecasts predict a further decline to $54,300 in 2024. These figures reflect the challenges within the mortgage industry, an industry that once promised steady income and career growth but is now showing signs of strain.

Factors Contributing to the Decline

There are several key factors driving this crisis. Rising mortgage rates, shifting consumer expectations, and the increasing reliance on technology and AI are all reshaping the mortgage landscape. Consumers are more informed than ever before, armed with tools and resources that were once the exclusive domain of brokers. Meanwhile, technology is rapidly changing how mortgages are processed, making it more difficult for traditional brokers to keep up.

One of the most significant disruptions comes from the rise of artificial intelligence (AI). AI is already handling tasks that were traditionally managed by human brokers, such as processing loan applications, offering loan comparisons, and even providing basic advice on mortgage options. As AI continues to evolve, the demand for traditional mortgage brokers could dramatically decrease, especially for those who aren’t adapting to the new tools and expectations in the industry.

Additionally, changes in legislation and consumer behavior—particularly the shift towards online and self-service platforms—are making it harder for brokers to provide the value they once did. Clients now have more power than ever to research mortgage options independently, leaving brokers scrambling to maintain their relevance.

The Hard Truth: You Don’t Know What You Don’t Know

The real issue for many mortgage brokers is that they don’t recognize the extent of the changes happening around them. You can work hard and put in long hours, but if you’re not adjusting to the new market realities, you’re setting yourself up for failure. The old ways of doing business—relying solely on referrals, paper applications, and face-to-face meetings—are quickly becoming outdated.

A recent CNN article even predicted that mortgage brokers could become a thing of the past, much like travel agents and stockbrokers. With technology, especially AI, continuing to disrupt traditional business models, the role of the mortgage broker is being redefined. Those who don’t evolve could find themselves irrelevant in an industry that’s rapidly embracing innovation.

The Survival of the Fittest

So, what’s the way forward? In this increasingly competitive and technology-driven landscape, only the brokers who are willing to learn, adapt, and innovate will thrive. The mortgage industry is evolving, and those who fail to keep pace with emerging trends, consumer expectations, and new technological advancements are at serious risk of being left behind.

Mortgages are no longer just about selling loan products and processing paperwork. The modern broker must offer value in new ways—whether that means leveraging the latest AI tools, providing top-notch customer service, or adapting to the growing demand for digital mortgage solutions. Brokers who can embrace these changes and pivot to meet the needs of today’s consumer will not only survive but will flourish.

Time to Reflect: Are You Ready to Adapt?

In conclusion, if you’re a mortgage broker, now is the time to evaluate your business model and ask yourself: Are you evolving with the industry, or are you relying on outdated methods that are quickly losing relevance? The future of the mortgage industry will depend on how well professionals can adapt to the changing landscape, and those who fail to innovate risk becoming obsolete.

To thrive in today’s market, you need to be proactive, embrace new technologies, and stay ahead of market trends. Only the brokers who can adapt to these shifts will find long-term success in a world where the mortgage industry is increasingly being shaped by technology and consumer expectations.

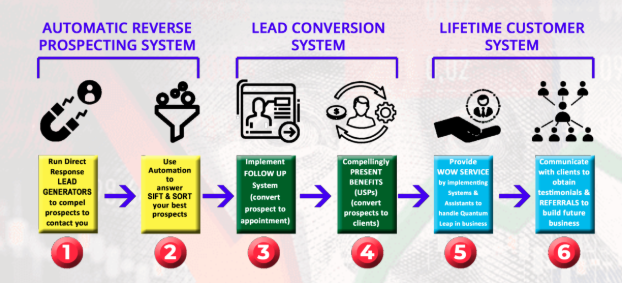

Join this FREE Live Zoom Training to Learn:

Post-Market Shifts: How to Earn More and Stand Out in a Changing Mortgage Landscape

How to Increase Your Earnings by 50%: Leverage your relationships with clients to maximize commissions and turn them into long-term clients.

Disrupt Industry Norms to Stand Out: Learn ethical strategies to rise above the competition and become a go-to mortgage professional in your market. Position yourself as the expert clients and referral partners actively seek out.

Top Lead Attraction Systems: Fill your pipeline with qualified prospects who are ready to take action—even in the current market. Learn what works to attract motivated clients and homeowners.

10X Your Profitability: Add more value at every stage of your client interactions and increase your bottom line, whether you’re working with first-time homebuyers, refinancing clients, or seasoned investors.

Mortgage Presentation Hacks: Get the tools and strategies to stand out in a crowded market, win more deals, and leave other mortgage brokers in the dust.

How to Generate Multiple New Clients from Every Single Deal: Learn how to turn one transaction into multiple opportunities—referrals, repeat business, and more.

Exclusive Access to Hard-to-Find Mortgage Products: Learn how to ethically attract clients by offering them unique lending solutions they can’t get from other brokers—such as off-market mortgage products, specialized loan options, and more.

Don't miss this opportunity to elevate your mortgage business and stand out in an increasingly competitive marketplace. Sign up now for this exclusive free training!